Ever thought about going on that exciting ski trip to the mountains or that relaxing vacation to a spa resort, but didn’t quite manage to save the money for it? Now you can stop daydreaming about lounging at the Sun with a refreshing glass lemonade in your hand, and really live this experience, with the help of this simple project. It’s not that people don’t want to save up, but they aren’t encouraged to do so in a creative way. Well, if you find yourself in this case, you don’t have to worry any longer for a solution, as we have an ingenious money saving idea for you. Grab:

• a jar;

• a piece of white paper;

• a ruler and a marker (or) a printed template;

• a pair of scissors;

• transparent tape;

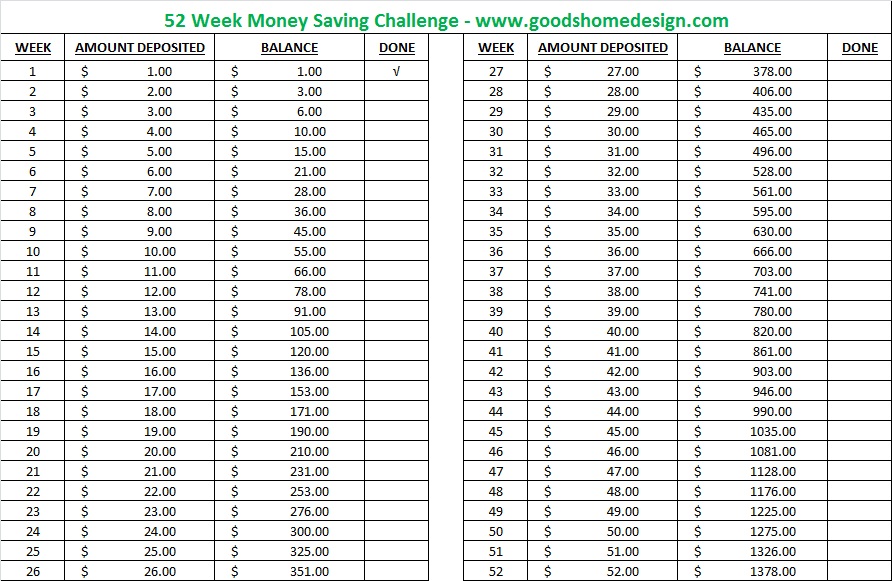

The process is very easy, but the creativity of the result is what will keep you saving money as much as 1400 $ after a year. Start with deciding if you will draw the savings table yourself (with a ruler and a marker) or if you will print a template off the computer. The choice is yours. When you’ve done this, take the pair of scissors and patiently cut a nice looking border around the paper. Then use transparent tape – glue isn’t advised because it will leave wrinkles on the paper and it’s kind of difficult to peel it off later on – to stick it to the jar. And so the money saving adventure begins. You’re welcome!

photo source: lifeasyouliveit.blogspot.com

photo source: lifeasyouliveit.blogspot.com

thanks!

I think it’s a great idea. We take a nice vacation with the money saved.

I think its a great idea! I’m going to start with the bigger amount first & work down. We are saving for our Wedding in September so I think this will be easier for me than just setting a little back here & there.

What rubbish, try that over two years or three.

Yes it is a good idea. Now look what he started. This is spreading like the covid 19.

Thanks for sharing for those of us who are glass half full.:)

I am actually doing this for myself, husband, and two kids so in total I have 4 going and I look at what I am saving up. on one of them I am doing different amounts every week to eliminate some of the higher amounts

Wow there sure are a lot of opinionated responses on here. I think that before being so quick to judge someones stupidity or inability to save (or laziness as some have called it). maybe that person withholding extra from their paycheck to get a bigger refund has no other way to truly save without doing it that way. who cares what kind of loan or whatever it is for the government if they get it back at the end of the year. who are you to call them stupid or make judgements on their decisions…yeah they could put it into the bank and save it that way, but have you ever had to decide between paying the electricity or feeding your family?? where no matter what you do your income isn’t enough to provide so there goes your savings. i think you guys need to step back and realize that not everyone does have cash in their pocket every day….$1000 is a lot of money to some people and those of you that always have $1000 this obviously isn’t for you come on people…..

@ Kristen who posted on the 1st of the year!

I love that someone on here has a head on their shoulders… meaning you Kristen. It good to know that there is still good people out there instead of simple minded ignorant people like those whom are calling this idiotic, stupid ect… yes your entitled to your opinion but y knock someone’s idea. You don’t have to like it but you also don’t have to be nasty about it either. This is a great idea to help your children learn the value of saving money and it’s worth. If one doesn’t like the idea then why comment honestly. I’ve been where some people are not have a penny to their names between pays wondering how I was going to make it. Not being able to save even 5 dollars out of a paycheck and still leaving below my means… I worked hard and was fortunate to get where I am today and not have to worry. Other people are not so fortunate to be there and are looking for any ideas to save money for their children, or for a way to just keep money on hand. Alot of people have problems seeing that money in their accounts and thinking hmm I can go buy this or that, where as if they put it in a sealed jar and know they are saving for a purpose, a goal, and it’s harder to get at its easier to save. So i agree 100% with Kristen!

Exactly. It’s a bit disheartening when folks denigrate even the simplist suggestion for saving. I mean, this example doesn’t have to be etched in stone! It’s the saving ‘principle’ that’s at play here, NOT the amount! I’ve done,..err…started a myriad of these one year savings ideas, and not one made it to a year’s fruition; but,…they all became a blessing when I needed to pay for a repair, a replacement, and/or wanted to help someone else with a need. I do know this. If you haven’t walked a mile down the ‘paycheck to paycheck’ road where it seems there’s always more month than money,…you’ll never find a textbook that can teach you that struggle!

Good thing it’s a challenge because if you have trouble saving or finding a way to save 1378.00 in 1 year, you have problems.

First off, in the last 4 weeks you have to put aside 202.00 ( small car payment ).

So, overall don’t waste your time on this stupid idea.

It’s a cute idea, a great way to visualize the planned for vacation or purchase. It’s about delayed gratification and planning ahead for something which I have found to be under-valued. And just to nit-pick, the highest payment is just 52 dollars.

I think you are missing the overall effect of this idea! You are essentially training yourself to waste $1 less every week. SO those last few weeks are nothing more than building on the weeks before. Not everyone can easily jump to putting $50 a week back without finding the small places to cut corners first. This shows you how to gradually manage these larger amounts. People don’t realize buying one less cup of coffee or finding out how to make laundry soap can quickly add up; this helps point out it is the small steps that build.

Well said!

If this is not for you, then don’t do it, but don;t come down on others who think this IS a great idea.

Ralphy, I understand that different people have different incomes, so if a person has a “problem” saving 1378.00 in one year depends entirely on their income. So your judgement has no context with most people.

Also, the idea is to progressively find more and more things you can comfortably do without. If you don’t make it to the end of the year, it was still a worthwhile exercise, eh?

How about offer an adaption, like to try 25 or 50 cent increments for a savings of 1/4 or 1/2 of the 1378.00.

Or make it 2,3,4, or 5 dollar increments, whatever looks like a challenge to you. The idea is to challenge oneself isn’t it?

If you can’t manage $49.00 – $52.00 at the end of the year……Hey! It’s Christmas! Just start over with $1.00 on July 1st. If that’s too hard, start over every 3 months. It’s still a pretty neat way to practice saving money. The thing is, you better start the habit while you’re young, because you’ll be old before you know it. Time flies.

Can you all just shut the fuck up. If you like the idea, great. If not ? Perfect. Im sure this post was a harmless recommendation, not a battleground for a shitty personal opinion.

Why not just save $26.50 per week?

this is a wonderful idea. but i have one small problem with it. we are 3 people living on less then 1,000 a month. 2 disabled and 1 teen. trying to just make end meet does not leave any for saving. not everyone has 1,00 to save, let alone 50.00 plus. thanks for adding to my feeling of failure.

Barara, you are not a failure, no one is when they have to live on very little money, I grew up on 240.00 a month and there were 3 of us, granted things were cheaper back then but to us it was a lot of money. we had to pay rent, utilities, by food and clothing with that. and my Mother did a damn good job of it and never complained about how poor we were. she saved pennies and change in a jar wasn’t much but she was able to buy us christmas and birthday presents every year. so no you are not a failure, failure are people who make us feel like we failed but in reality we are the survivors as we can live on very little. have a good week end.

Pretty sure with all that money you’re saving, you can afford to buy another jar if you can’t get the paper off if you happen to use glue.

That’s why people like you never get rich

What the hell is the point of being rich if you are so miserable trying to save the money to get to that point?

If you consider having $1378.00 dollars “rich” then may God bless your soul.

Probably 99% of the world’s population would consider this rich. Just sayn

For some people having an extra 1k laying around is rich! Not everyone makes 6 figures going out the gate or EVER. Or maybe this is a young HS person or college person who does not have a lot. So yeah 1K extra is rich!

must be nice to have your money

Having $1,378 does not make you rich. Changing your spending habits so you can save $1,378 for the first time will create an outlook on money and spending that make you rich.

This is saving above and beyond. And if you are rich, I pray that God will use you in a way that will help the less fortunate this year!

My husband and i live pay check to pay check most weeks not having money for food, gas, diapers, etc. We have two small children and dont depend on the government to support us (not that that is a bad thing at all). 1000 dollars would be amazing for us. I would be happy with an extra 100. That is where most of America is at right now and it isnt by choice.

Well, sorry to tell you, but there are a lot of us out there. A lot of us who were hit very hard by the bad economy, and who live that hand to mouth lifestyle, whether we want to or not.

I’m rich Thts change to me just saying

I take home about 65-85k a yr on average after taxes. after paying my monthly bills

child support 600

rent 600

utils 200

car payment 450

car insurance 150

gas 300

tolls 50

cell family plan 200

insurance surcharge 200

food 400

total is 3150 a month or 37500 per yr in just bills and living expenses that means I have 30k a yr for spending money and saving. and no matter how hard I try I have not been able to save anything. I know people that make less than half what I do and they own a house and save. I blow more money than half the people I know make in a yr and I don’t have a drug problem. saving isn’t as easy as everyone thinks

Changing your income isn’t the only problem. Review your bills and see where you can downsize on costs. You spent close to $1000 in driving a month. I would recommend seeing an advisor and looking where you can adjust.

Your car payment is wayyy too high. You need to cut it in half and save $225 per month…which would make your insurance go down a little bit too. If you have $30k per year in spending money, no reason you can’t save a few thousand. Jis sayin’ 🙂

He/she’s never gonna be rich because he/she would rather spend $2 on another jar? Are you some kind of retard?

I think that was a joke

Definitely a joke! Maybe you’re the retard

You should think twice before using the word retard… And the lady is just trying to share an idea… Karma can be a bitch.

karma is not real. mean people win/nice people lose

Depends on your definition of the word retard. Most people use it in place of words like, stupid, moron, idiot.

Well that’s fine for those people who have enough money to do that but it’s insulting to those who have hardly anything left over at the end of each week.

Plus, why is it any more exciting than saying that you’ll put in $25 every week? If people can afford it anyway, they’ll probably be able to budget for that.

I agree, this is mostly good for people who spend frivolously and don’t save, so instead of going to starbucks 2-3 times a day they can play this little money game with themselves. I don’t see anyone – even people with plenty of money following through with this, it would get old after about 3 weeks, who has actual cash on them every week anyway…

Best way to save: I claim less allowances on my w4 (of course not everyone can do this- if they can only claim 0), it makes weekly living pretty tight but i get a fat return at tax time we can do something fun with (sometimes). Best savings account ever because the IRS has it- making it untouchable until April. Otherwise my bills would gobble it all up.

When you give the IRS extra money, you are letting them make money off your cash. You are giving them an interest free loan.

And I have cash- it is how we spend- easier to not overspend on groceries, entertainment, etc, AND save.

I know it sounds dumb to those who have more, but this is how many people get by. For the hubby and myself, after raising our family, it cost a small fortune. If there was “extra”, someone always needed something, making the “extra” go bye-bye. For us, that once a year “windfall” made the difference in being able to do something a bit special, like fix or replace something that was broken.

By claiming less exemptions than you are entitled to, you are allowing the IRS to earn interest on your money all year instead of YOU putting that same amount into a savings account. If you can afford to have it withheld, you can afford to put it in savings. It really comes down to whether or not you have any self control at that point.

You are loaning money to the government, but if you have less than $50,000 to put in a money market account you might as well loan it to them as put it in your local bank. A Merrill Money Market account through Bank of America is paying 1.09% APR for $50,000 and up in a money market fund with, of course, many penalties for early withdrawal. For that interest you might as well give it to the IRS if you are likely to spend whatever you have if it’s cash.

So basically, you’re always giving a fat, interest-free loan to the government.

Very true, but for people who are unable to save money on their own this is a good way to do so. They end up with a lump sum in April that they would not have had otherwise.

“Unable?” That is a weak excuse. Don’t characterize people with weak minds as “unable.” They are simply weak-minded, not “unable” as if it’s out of their control. They are fully capable, they choose not to.

Agreed, especially for someone facing garnishment.

True story. Years ago, as a single mom, I made sure I had them take extra off cash off each pay check so after income tax season, I would get a large enough refund to buy major purchases I needed with cash instead of credit (like my deep freezer) or to get my Christmas shopping started, etc.For me, this was the best way to stay afloat. And I would rather be ahead of the tax department and have them owe me, then have to cough out money to them when things are already tight. Overall, I guess if whatever strategy gets you ahead, it’s the right one for you.

“Best savings account ever” that holds your money for a year and gives you zero interest lmao oh man

You are giving the IRS an interest free loan. Why not claim the proper withholdings and invest that extra $$$ every week. You know you can live on less so just hold yourself accountable and do it.

So you get a whopping $5 interest after a year… actually that is a gross exaggeration… probably more like $2… almost enough to buy a cup of coffee at McDonalds.

im doing this so i dont spend all my money on car parts but im doing the $25 a week and i hope i can follow through with it because i just have a bad habit of spending all my money on car parts

I started it last year, and have stuck with it every Wednesday. I’m not frivolous, and sometimes toss in the extra change I find in pockets. I have over $1000 in the jar, and will definitely be doing it again this New Year’s Day. I think I’m going to buy my husband a new laptop, his is toasted!

We did this last year and it worked wonders. We saved the bulk of our spending money for a two week vacation this winter. We did make one change however….flipped the amounts around…started with week 52 and counted down. This meant that come Christmas time, we had more cash to spend on the family and didn’t derail our savings plans…Worked like a charm…doing it again this year…Every friday without fail 🙂

The reason I give the IRS an interest free loan is because we used to claim all our allowances on the W-4, then one year after filing taxes, we ended owing $2,000 in taxes because of underpayment. We couldn’t even begin to afford to pay it all in April, and so we ended up paying it back on a payment plan that included interest and penalty fees. I MUCH prefer giving them free Interest income to save my money for me and then a happy payday during tax time.

Hear, hear! This is why we did it, too. Because when you are living hand to mouth, paycheck to paycheck, feeding the kids and so on, getting slapped with ANOTHER bill was devastating. Sometimes $10 extra is as out of reach as the moon, and getting a $2000 bill from the IRS is a horrible adventure that you DO NOT NEED.

You can get a fatter return if you claimed the correct amount and put your money where it can generate income. Ask your banker!!

Umm… have you guys checked interest rates? Those extra pennies sure would make a difference, huh?

I let the IRS hold it for me… I consider it no-fee banking, and it costs me a grand 0.02%.

Wow.

$2 per year… wow.

Have the IRS withhold more!!?? That’s real bright, let the government hold your excess funds for you earning no interest. You are better off maxing out your withholding allowances and putting that difference into an interest bearing account. I understand that todays interest earnings are very little but it beats nothing (nad that’s what you will get with uncle sam).

I think Rachel has a great idea… If you get say about $3000 in tax return, you will lose about $20 on interest over a year to IRS, sure if thats what it takes to make sure you save $3000 over a year!!!

When you see money in the savings account, more often than not, you find some excuse/reason/emergency to spend it all.

Just my $0.02

Starbucks 1x a day is going to be $20 a week. A cheap lunch out once a week is another $7. Making coffee yourself and your own lunch and your already saving a little over $20 a week.

I don’t make a lot but by purchasing clothes at box stores and only when needed. Cancelling my cable and removing data from my cellphone combined with limiting myself to eating out / going to the pub 1x every 2 weeks instead of every week I save $80 a week. I put a majority of that into savings with some of it evaporating to an extra pub trip or a forgotten lunch. But most people I know make around $25,000-$35,000. They spend likely upwards of $200 a week on things they want rather then need. So for a majority I think you can save $25 a week fairly reliably and its probably a good lesson in the value of a dollar.

A $4 coffee doesn’t seem like much until you think of it as $1000 a year.

Really? You’re “insulted” that some one showed that by saving a saving a certain amount every week, it builds up? Grow up.

This is insulting to those who max their 401k each year. $1378 a year!? I save ~3x that a month.

Lmao than why the hell are you on a blog about saving money if you have so much. Not all of us are so fortunate to be able to save 3x that a month, which you probably do so because you took over daddies business or something probably got it handed on to you on a platter.Hope your money keeps you warm at night you cold *******

Than this article obviously isnt for you so why are you commenting, most of us dont even make triple that in a mnth nvm save it you douche. Hope your money keeps you warm at night you cold *******

My family cant save 3 times that amount in a month. Glad you have that ability. Not very nice though to show others how much better you are than them. Maybe u should use that extra money to help people instead of flaunting it. And it isnt because we dont work or because we are lazy, my husband has three jobs, i do odd jobs on the side and at times we still cant make ends meet as well as others in our small community. Pride is very ugly, u should be a little more humble.

lucky you. We don’t even MAKE 3x that a month, much less be able to SAVE that much. That $1378 saved per year in small amounts, multiplied by several years makes for a savings account… which is something most people DO NOT EVEN HAVE anymore. It isn’t “weak minded” or anything beyond the fact that not everyone makes that much. Period. And, a small savings is far, far better than NOTHING at all.

About time the voice of reason speaks up. If someone can handle 50 bucks a week, start with that. If u set the goal so 1300 for the year, give yourself a real challenge, otherwise you are minimizing your potential.

Why is it insulting? Everyone can save something. Even if it is only cents or a few dollars. It does not matter. It just takes you a little longer to get there, but you get there.

If you can’t figure out which of your vices needs to be culled for the duration, then you’ll never have enough money to do anything. Willpower. You may smoke, drink, eat fast food EVERYDAY, or whatever… maybe while doing this you can find lifestyle changes. Even homeless people can budget, bro. It just takes the WILL and the WILLPOWER to achieve the goal.

why do you assume that people who have low incomes and nothing to save have no “will” or “Willpower”? Why do you assume that even “homeless people” have anything to save? Why do you assume we haven’t already cut out all the “fluff”? no vacations, no new clothes, no new car, no pricey toys, no drugs, no booze, no smokes? And that we haven’t sacrificed our own futures for our kids’ sakes, to lift THEM UP since we won’t be able to end up living the good life? We and many, many, many, like us have already given up ALL of that… and are just scraping by. Seems that people like you must be living pretty well to be able to make sweeping judgments like this, have never had to live in the lowest 1% for income. So, I am both happy for you, that you live the good life without adversity, and sad that you have no understanding and compassion.

“Insulting”!?! You weakling…

So do it in different increments instead. You could do $0.25 or $0.50 increments. You won’t save as fast, but it’s better than nothing.

You must be a very unhappy person. Good grief…

Why would you assume a person is unhappy simply b/c this idea isn’t for them?? I personally would rather have my Starbucks everyday, that’s part of my happiness for the day. Everyone has the right to do as they please with their own money! Sorry, but your logic is WAY off, and not to mention, very rude….

Anyone can do anything the want to do. Sorry for those that feel they are victims. Thankful for my husband very hard and in his efforts to provide for our family and supporting me in doing the same . Just saying

It’s not about feeling like your a victim. It’s about knowing your income!!!if I you only had $1300/ month to pay your bills… Can u save? Try it!!! That’s my income every month. Let me know how much you can save; work out a budget and figure out what bills get paid and which ones don’t!!!

My income is 800 a month. And I live within my means, and I have some extra every paycheck that I get to decide whether I play or save.

Income isn’t the issue. Priority is. A generation or three of people who were never taught how to budget and live within their means is the problem.

Priority is? Do you have kids? I make $1,600 a month, I have rent, a car payment, car insurance, food exspences, utility bills, and other every day expenses, and even I can’t put away money. I’m a single mom of 2 boys, and I have to help my parents out. My priorities, are my children… Making sure they have food in their stomach, a roof over their head, clothes on their backs, heat in the house, water running threw the pipes, and electricity to keep their food fresh. So your right. It IS what your priorities are. And MY priority is my children. Not taking money away from their care

that’s bullshit…. maybe you live alone and someone with 2k a month has 3 kids…. moron

I agree with Brandy. Sorry, but when you have kids – whether by accident or design – they should be your priority. You do what you need to, to lift THEM UP, so they might have better. A $50,000 savings account when they are wearing rags and have empty tummies and no roof over their head is UNACCEPTABLE. After they are grown, then you change your focus to try to lift yourself up. We are there now. The youngest is grown, and we are trying to find a way to save something, anything. Chin up, Brandy. You will make it, you will get there. Until then, keep on fighting the good fight for your kids.

Just saying what? Did you even read your comment before submitting it? You’re thankful for your very hard husband?

Who wouldn’t be thankful for a very hard husband? Ha!

Well, you know what they say –

A good man is hard to find,

But a hard man is always good to find.

Seriously, though. This little savings idea is a good idea regardless of income. If you’re mxing on your 401k then it makes for a nice bit of pocket change on your next vacation to a place where the natives only accept cash, and if you’re living paycheck to paycheck it could be the means to making due the kids have a little something under the tree at Christmas. Anyone saying this isn’t a good idea or who wants to talk smack about the mindset of someone who finds this method easier than others needs to step back and take a good long look at themselves before judging others. Those of you who want to accuse those with money of not knowing what you deal with need to stop and think for a moment, because most people are not born into money – they work hard, scrimp and save, and finally have something to show for it. Paying attention to their suggestions can prove beneficial, and if they’re not being nice then ignore them. Never give a fight to someone who is looking for one.

Please excuse me for jumping on my soap box for a moment.

Sounds like you need to go get a degree…

Or lay off the smokes and bud, and the bud. Imagine how much half of the people complaining here could save if they laid off the booze and weed!

I put back $500 a week because I work my azz off.

Insulting. You could do away with your internet. I find it crazy that people say they don’t have $ for anything yet they have a cell phone which is a luxury!

Calling the internet and a cell phone a luxury is tantamount to electricity when it was starting to come around.

Could you live without electricity I wonder? Not many can.

internet and cell phones are NOT a necessity, they are a “luxury”

We went over a year not having internet at our house after having had it for over 5 years. I only occasionally missed it.

We choose to have internet and cell phones, but there have been times that I’ve thought about getting rid of both of them and saving the $300 a month we spend between internet and cell phone bills.

Try finding a job without a cell phone. Just. Try it

I partially agree with you on the cell phone an Internet. I actually go to my local mall that has free wifi. My iPhone 3GS was given to me as a gift two years ago and I pay $25 a month for it. It’s my only means of communication if I need to call work, or if they need to call me. I use it purely for that or for emergencies, such as a car breakdown. Prior to this, I had no phone, and it was a major inconvenience when my car wouldn’t start in the morning and I couldn’t call to let work know I’d be late. This was what actually prompted one of my managers to give it to me, since they had no use for it and already owned the iPhone 4.

I beleuve everyone should have a phone for emergencies, but you don’t need a $100+ bill. If its just you on that plan, $20-$40 dollars a month should suffice for basic service on a cell phone.. 250 minute and unlimited text is what I get for my $25 a month, and it works for me, and it’s prepaid so if I’m in a really tight financial bind, I can avoid paying it until the noose loosens on my wallet.

Or, cut the cable and use month to month cells like straighttalk. Instead of spending $300/mo, you could be spending $90.

The point of this is to save money in a creative way so that people actually stick to it. everyone’s different so different things work for different people.

yes, people living in poverty are not in a position to save for a ski holiday. the beauty of this idea is that

it makes it a bit more fun

in the first month or so, it helps form a painless (for most people) habit. the difficulty of putting in $25 per week (and more) is balanced by the difficulty in letting yourself down by abandoning the dream/ project. personally, I’d find putting $25 in a jar hard to start, but I’d also find giving up on my habit of the past 6 months hard.

And, if you do the calculations, putting $25 a week in a jar only saves $1300 a year. Slowly building the habit of saving this method offers actually saves you more.

Personally, I also find it daunting to put a larger sum away every week then slowly building up to it. My husband and I are each going to do this starting this week so we’ll have double the amount. I’m going to try to keep my own jar and do it on my own so I’ll have some of my own spending money.

Hello,

Do you have a premade label like the one in the picture?

It takes about 5 minutes to make one on an excel spread sheet haha

just print this one out, that is all I did

You can right click on the picture of the chart, and save it like a photo, then print it.

I’d think it would be easier to deposit $25 per week = $1300. I’d think the larger amounts would be more difficult for some people to cough up each week, and they’d give up. Now if they can add $2 more per week, that would give them $1404 in the end.

Or give them several options just to show what they could end up with in different denominations, ie $50 and $100. $2600 and $5200….

Our Credit Union has a very similar deal called the Christmas fund and the money is automatically deducted from employees paychecks, if they chose to do this. Some use if for Christmas and others to buy CD’s or other investments.

Which works out great for the bank as they get to continue holding on to that portion of your money while they make money on it in the process. It would be better to take the money and invest it yourself in an interest accruing account.

Interest bearing account? What’s that? Seriously, please share the name and location of your great interest-bearing account. I’m hard pressed to find anything better than .02% lately. Not much better than stuffing money in a sock drawer.

You could invest it into a EFT through a company like eTrade or TradeMonster. That way you can divest easily to have cash should you need it. Many, many EFT’s are performing quite well this year.

I don’t get what the problem is with the bank making money off my money?? As long as i am not losing any of mine, why would i TRY to keep someone else (business or other) from making anything??? I don’t get it…someone explain.

I totally agree with what you say. This plan starts with adding a dollar each week and as you get towards the end of the year, you are depositing large amounts each week. Just spread it out through the year and it will be a whole lot easier. A little goes a long way!

This is a great idea, but I would probably mix up the amounts so it’s more manageable throughout the year & not trying to put away the majority in the last few months of the challenge. $1378 averages out to about $115 a month, so I’d try to make that my goal each month, but still have the weekly challenges.

If I had $50 a week, $200 to $250 extra a month I would doubt I’d have problems paying $1400 for a fking vacation, this is stupid

I think the point is for those who are not disciplined or who spend their money thoughtlessly to make a point of putting it away and allocating it like a bill, then you will have it. No, that is exactly the point, and you are too fking stupid to see it.

So put it towards something useful…like saving for a vehicle. Every 5 years or so you can get one that’s decent. Not new but reliable.

I glue the lid shut as well…..if I left it open it would be too tempting to dip into! And its fun to smash into it at the end to get your ‘reward’!

I do the same thing with my jar, Tracy! 🙂 I make a Vacation jar and mod podge on pictures of the destination and then I superglue the lid on.

This is a great idea. But seeing as though (like most people) I get paid every two weeks I think I would find it hard to put in $103 from my last pay of the year considering the holidays. In stead I will write down the amounts of $1 – $52 and put them in when the best fit my budget… extra money because of holiday pay…or birthday money…tax refund etc. Smaller amounts when budget demands.

That’s a really great idea! 🙂

If you don’t start this on Jan 1 (Start in late summer/early fall) you wouldn’t be putting in large amounts during Christmas it’d still be around $10-$20/week which is a lot more manageable with the holiday seasons.

I like that idea of looking at the year realistically. Additionally, if you got a had a little extra (3 pay periods in a month for example), you could do more. The month the car registration or other seasonal bill is due you save less.

Good idea!

Who says you need to start in January? Start any week that you want & make that yur week 1. June would be a great time, for me at least, so the higher amounts nearing week 52 get put in when our household is getting more hours/OT at work as with seasonal occupations. Tailor it to you. Like most are saying here- any plan & action to save $ is a good thing. We all have to start somewhere, even if it’s pennies a day all 52 weeks.

If you started right now, you’d have all your spending money for next year’s Christmas 😉

You could also reverse the order of “deposits” with the $52 being added at the beginning of the year, when the resolution is new and fresh, and dropping off to smaller amounts as the year progresses, so that as one’s intentions get overlaid by life, it is a smaller affect on the overall savings.

We have done this the last few years but do it backwards, for us it was much more feasible to save the bigger amounts earlier in the year compared to during the holiday season.

That’s exactly what i was thinking start backwards, so the big amounts are done

Good idea, and this also may enable u to save more cuz when you reach the lower $ amount weeks, you mite have extra $ from tax returns or what not

Love the idea if doing this backwards, thanks for the tip.

What a bunch of negative Neds and Nellys. Someone comes up with a creative way to save money, and all you can do is remind us of the old-fashion way, or the have-nots that can’t do this. There are some very real benefits to this method beyond the mere fact of saving money. Try looking beyond that nose you are looking down on.

Ha awesome, u said it. If you take it right when you get paid like some kind of tax, it’s gone just as if u buy something you really can do without. I’m doing this cause I’m not thinking ever of putting money away to save and I can as anyone can. You decide how much to save every week. Next time you’re at the store think before you buy something. Ask yourself, ” can I do without this”? Do I want this stupid thing or do I want to go on a nice vacation next year? You know the answer, and you can get excited every time you do this, to actually look forward to going on that vacation or buying something that you have always wanted. It will also help by having the money for the things you really do need thus making saving possible. I love it.I want to go on vacation, anyone else? Of course. I’m really glad to have come accross this, and so simple, but without the inspiration I wouldn’t be going on vacation next year. Thank you thank you.

Worth to try 🙂 Will not hurt anyone anyway <3

Back in the 70’s, the banks had Christmas Clubs where you put $100. per month for 10 months and they gave you 2 months = $1200. when they gave you the lump sum. Not anymore.

Now days a person living on Soc Sec Disability can barely make ends meet, let alone save. I try to do the best I can, but there is always some darned thing that ruins it, like health care co-pays, having to buy a new tire, raise of rent, clothes washer belt broke, etc.

Good luck to those who can do it. It’s a great idea for those who can.

Dear everyone who is criticizing this idea,

This idea is exactly that: an idea. It is not a new law that was passed. Feel free to adjust this to fit your needs, or ignore it all together. The time and energy you spend on ripping apart other people’s creativity is making his world a depressing place.

The end.

Amanda, thank you. This was supposed to be the point exactly. You do whatever you need to do and can do.

I have been on both ends of the financial spectrum and I find that if you are persistent, there are ways to save if that’s what you want to do, even if it’s just depositing that extra change in your purse every chance you can (be it in an account, a tin can/ jar or old sock that you hide away). As a single mom, I had to get my employer to shave extra off for me each month to get that bigger income tax check in the spring. But I also had a stash sock in the closet for extras when I could scrounge it. Now I have $ automatically withdrawn into a hidden account at my bank that I can’t see unless I go through a bunch of work. But for me, the No see= no touch idea works best.

Try starting at week 52 and count backwards to 1.

Love that idea!!! So it only gets easier over time!

Why not start off with 52 and end with 1? It will get easier and easier every week, and you pay in less the time of year you need the most money 🙂

Cool math coincidence

Save $26.26 x 52 = $1,365.52

$1,365.52

1 = 1 year

365 = 365 days in a year

52 = 52 weeks in a year

$1,365.52

lol….awesome coincidence 🙂

A good way to do this for people worrying about the higher amounts at end of year us ti do it backwards starting at $52

This is the dumbest idea I have ever heard. Golly. If only I had creative ideas to make me save money. I’m just too stupid to do it with my own little mind. To think I’ve been putting it in the bank to earn interest when it could have taken up space on my dresser collecting dust and lint. And when I don’t have enough, it’s a great reminder of how poor I am and how much my life sucks. Stop overly simplifying complicated issues with your useless ideas.

Honestly you must buy a few things each month that you can really survive without or you buy something u need but can buy the cheaper version. Maybe you bought a Pepsi at the gas station even though you would have been fine till you got home to get a drink. Simple things like that you can save with. We don’t think about all those times and it all ads up.

You said it best when you said you were too stupid. The proof of that is when you stated that you put it in your bank to earn interest. How is that 0.019% treating you? Ha! You’re probably really cool in your mobile home court. It is an idea for people. It’s obviously not for you, because as you’ve stated, you have a much more lucrative way, so move on. Rather than criticizing and condemning an idea, then attempting to post a clever comment that makes you look like a donkey, just troll along….

If you’ve made it to this comment, you really are bored or you really care what people think about this little old man’s piggy bank.

Here’s the truth! Know your weaknesses in saving money, be honest with yourself, and do what you need to make saving happen.

A penny saved is a penny earned 😀

Or do it in reverse… start with 52 then by the end of the year you are only putting a few dollars a week away and have less worries about holiday spending…

IF you feel this is too much why not save over two years instead..I am on old age pension and it would be difficult some months. So I will half it..

If you cant afford 52 a week. You need to budget better anyways.

Any incentive to save is good. Thank you for this idea. I’m a disability pensioner, so definitely on a limited income.

Any incentive to save is good. Thank you for this idea. I’m a disability pensioner, so definitely on a limited income.

This is such an easy method that actually works. I have been doing this for years and designated it as my “gift” fund. It becomes really disheartening when you “short change” some you care about on a gift because you’re running low on cash weather it be for Christmas, birthdays, anniversaries, etc. One way I’ve found to make my gift jar “more profitable” is by putting all my lose change in it, as well as any additional singles I may have in my wallet at the end of the day when I go to bed. Also, parents, this concept should really resonate with you as you can turn it in to a makeshift college fund OR use it as a means for your kids lunch money for school. The sum of a little is bigger than a lot and this simple, easy jar can be extremely beneficial!

Great idea and you can alter the weekly payments to suit your budget. The key is consistency; making sure you put money aside instead of spending it on coffee or things you think you need but don’t really. People complaining about this idea don’t seen to realise they can change the amounts to suit them, or they don’t realise how much money the are actually spending on ‘random’ things.

I agree with you cali I think it would be best starting with the higher amounts that way when Christmas comes around your down to the $5 or less each week

i remember when I quit smoking, I thought if I afforded those cigs for so many years I can still afford to put that $3.00 away every day I smoked, worked for about a month, don’t really think it would work now as everything is 10 times more expensive now so who can afford a ski trip with a family these days unless you have money already, which most of us don’t. When we have kids to raise etc

But it sure sounds good

This is so hard when u live paycheck to paycheck…and still can’t pay all your bills. but what is easier is when you go to the store and pay w cash take all of the change and put that away….at the end of the year you have quite a bit saved….my dad turns his in around the first of of he year and gets anywhere from 1300 to 1900 each year just in change. Its just an idea.

I think its a good idea. 🙂 Not sure why people feel need to always be negative. If you dont like it dont do it. Its just an idea to build from or make your own. Im not very good at saving so would love to try something new. Thank you! 🙂

I think its a good idea. Not sure why people feel need to always be negative. If you dont like it dont do it. Its just an idea to build from or make your own. Im not very good at saving so would love to try something new. Thank you! 🙂

Some people like me cant just start off with your 25$ a week savings. The point on this one is that you can adjust yourself (your budget/ your current expenses/ and whatever stuffs that are keeping you away from having some extra money by the end of the week/ month) from the tight budget that you are going through.. At least you can now find a way/ learn to minimize your budget everymonth in order to achieve your goal.. No one is forcing you to reach the 50$+ a week savings as its being said on the article .. Your just setting a goal to your saving challenge but at least by the end of the year, instead of having 0 savings, you can have quite good amount of savings that you have never imagined to have..

Just do it backwards. Week 1- 52.00

Week 2- 51.00. Etc. This way you’ll still have the same amount and it’ll be easier around the holiday

Everyone’s crying about saving small amounts. If you can’t spare $50 a week, you don’t need a vacation, you need to go to work. You probably spend that amount on frivolous items and don’t budget well enough to notice it. You spend $7-$12 on lunch each day? That $6 Starbucks coffee. That new shirt or pair of heels. At the end of the day, it’s a creative way to save for those less likely to do so.

Oh the QQing going on in these comments. It’s a suggestion people, modify it as you see fit for your own needs. And I do agree that making the amount more even is better. But seriously, most people can save 1-5 dollars a day or 20$ a week. I have been serious poor, and could still save some when I needed to. Starting, no matter how small, is better than just complaining that some can’t. And for most of those who ‘can’t’ it’s more of a ‘won’t’.

I think this is awesome, I saw this last year and for one reason or another didn’t do it (prob just forgot). I just printed out the weekly schedule, and will implement it ASAP, I think I will do 3, 1 for myself, my husband and my daughter to share with her brothers. should be accomplished for next year before xmas.

An alternative is the change jar. If every time you buy something with cash you NEVER use change. Take change, throw it in a jar (we use old water cooler jug). You’ll be amazed at how much adds up and you never notice the “loss” of cash throughout the year. Have a coin rolling party with family (Thanksgiving weekend is ours).

Someone could have a printout of all the weeks and prices available for when they get paid. Say I work over this week and have overtime money I could do the $52 this week and mark that number off. Next week I may only have $6 then I could mark it off. It doesn’t matter what order you go in just when you have extra money do the bigger amt.

I like this idea a lot, even more than the “Start with $52 and go backwards” idea (even thought that one was great as well, especially since you would be saving only a few dollars around the Christmas season). Thanks for sharing.

Julie,I think your idea is good!

To those of you who say you can’t afford it towards the end, I think the idea is to get you to start saving. I always have trouble around Christmas coming up with enough money to pay for presents. I decided I could manage $5 a week. I saved up about $150 before I ran into money problems in the summer but got back to saving again and now I have $85 saved again so far. That at least covers two or three presents for my budget. I think next year, I will up it to $10/week. If I don’t run into any emergencies, I’ll have saved $520!

It’s a shame that anyone would need a “challenge” such as this to save $115 a month (averaged annually). Of course I mean this as no insult to those with unfortunate circumstances, but rather to those who – like most – have no idea where their money is going.

Man I’m amazed how people commenting here seem to get so upset or offended from a simple idea someone has to save some money. And I’m also amazed that paying yourself a maximum of $52 and week is so far out of reach for someone to do. If you are that tight on cash you should be looking at your finances and seeing where changes can be made so you can save $50.

If you don’t like this, you can simply not do it.

Wow, I never thought of saving money in a jar…;)

If you don’t want to do it with cash, open up a secondary free checking account within your bank account (extremely easy to do, call your bank if you don’t know how). Use online banking and transfer the money each week. Just make sure it’s actually a free checking account first.

So many negative comments! Look, I attended a class on saving for retirement. Lots of people said the same thing….sounds good, but living paycheck to paycheck = no money available to save. Man proved this was nonsense. It’s about paying yourself, first. Cut out one drive-through coffee per day, stop smoking, drive 10 fewer miles per week, buy a $5 less expensive wine, use vinegar instead of windex, etc, etc. Americans are worst savers out there. This was a novel and interesting idea and I think it is a great way to teach people how to set goals and save.

Like so many posts everywhere, so much negative. Why be nasty or snotty?

Some things come easier to others, especially money. How would you nasty negative people like to be put down for your physical features or the fact you can’t fix a toilet in your own home!?

This is article is just pointing out that saving like anything is a learned behavior. And proves that starting small and being diligent will lead to bigger things.

WOW why so negative? It was just a creative suggestion to help you save some money. I personally dont spend any change I only pay with dollars and all my change goes in a jar. I use it for Christmas presents and get about 600 dollars a year from just doing that. Now, how many people can come up with a real negative and nasty attitude for that one? Come on, I know you have it in you.

This is cool n fun.. im going to do 2 of this.. one from 1 to 52 n the other for 52 to 1..

I do the $dollar challenge at the end of each day I take all my one dollar bills I have left over from the day no matter how many or few and put it in a safe place … you be surprised how much you could save up for a rainy day.

So many of you are missing the point because it is apparently so much easier to just whine about what you don’t have. The point is to save SOMETHING. The reason that it is set up to start with $1 and increase by $1 each week is because it is very easy to say, oh its just $1. By the time you get to $52, remember that it was only 1 more dollar than the week before. It is building up to figuring out how to live with 1 less dollar available each week.

I get a kick out of the 100 dollar bill being in there… seeing there are no 100$ deposits.. It would be best to glue it shut and use a non transparent container

Sorry in advance for this long reply

However this technique really helped me and just wanted to pass on my experience.

[Just a heads up – I’m definitely not a writer so may have several grammar errors].

– I wish they taught this easy way of money managing as a possible 2 month fun project in elementary/ middle/and high school in different denominations of the amounts. Even if it just started with dimes and/or quarters. Or even monopoly money. .

I just happened to do this great easy technique of the jar saving back in the age of my 20’s * 20-27 to be exact*… and yes the first week or two (in my opinion was challenging mostly due to the discipline) I started with $2 a day at age 20 back in 2003. I agree it is sometimes difficult to have cash these days with the easy access of the well known debit card (which is so easy to swipe isn’t). Although during these times of savings I put the debit card aside and just withdrew the money needed for the day or two. (I agree very inconvenient) however, I definitely spent a lot less not swiping (just like they say it’s tough to break a $50 bill when you have it in your hand) for me it started to be tough to break a $20 bill in my hand.

The greatest feeling was how quickly the money grew in the jar and how fun the game became by counting the money every week or so and by the 5th month or so I was counting every other day due to how much there was in that small little jar. . I was in my 20’s so the saving process would only last about 5 -10 maybe 15 months – often not longer before I spent it all; although I would always just start over.. Luckily when I spent it all it was on something big and/or rewarding instead of a fast food or a Starbucks trip. Granted I did hit up these joints during these saving times just not as frequently as once before – due to slowly transitioning into the budgeting that the (jar saving technique) pretty much made me do. Sometimes money was tight sometimes very tight depending on my job situation during those 7 years or so; however, I just changed the denominations sometimes only down to .50 cents from loose change I received.

Another great thing with the jar technique was how it became a game for me {which just happened to be a great game that taught me the value of saving}. – Being able to count up all that money that I saved in such a short time.

I just know for me it was a really helpful technique for myself years back and instead of a paying with a credit card for a surgery I had in my 20’s I was able to pay it with the amount I saved just by playing my saving jar game.

Enjoy the game.

This just came to my mind now writing this – even if you do not at this moment have .25 cents or a dollar to save a day (at this particular moment) try maybe with monopoly money just so you can experience how fast it grows..because I guarantee you will have money very soon I know this just because you clicked on this savings blog/article to begin with and took the time to read it. Best of luck to you on your money adventures and have a profitable day..

I hope to you all healthy and wealthy success…

The book I read to get me started on this that I recommend if you like to read is

“The Richest Man in Babylon”

(Not much of a reader in my 20’s however it is an easy read which was helpful to get through.)

By George Samuel Clason

(surprisingly this book was published in book form in 1926) however still a great great read..

Good luck to all and to all a good night…

I would definitely recommend playing the jar game if I were you…You will be surprised how quickly you will meet your goals..

Especially if you play “”Double It””I haven’t played this one yet –maybe one day “actually” now that I mention it I’m starting today. Yep I’m starting today its not easy though of what I’ve heard and the money grows like you’ve never seen before… In fact – if you do play this Game you might want to open up a money market saving account/saving account at your local bank because it grows fast and it might not be best to have all that money in your home/jar.

It’s when you start with a penny and every day that you (can afford) to put in another amount/deposit into your jar/savings account you put in the doubled amount of your last entry (not necessarily everyday just when you are able to double it).

“DOUBLE IT”

Starts off in cents so you may be able to do it day after day at first however when as the game gets further just do it when you budget and save to finish your game goal. Challenge yourself make it a great goal of money.

Day 1. -One little penny. “Double it” Day 2- two pennies

Day 3 – only four lousy pennies (it’s small now oh but wait there’ more.

Day 5 – 8 pennies (Don’t cheat now and put all of it in for the week this is where the game comes into play and you start building your discipline for when it starts getting difficult. It makes it so you want to participate all the way through starting with only a penny. you will want to be putting money aside for the days to come because it starts growing fast after we are on day 11.

Day 6 – 16 cents. Day lucky 7 – 32 cents

Day 8 – 64 cents Day 9 – $1.28

Day 10 – $2.56. Day 11 – $5.12

Day 12 or day of 12th deposit – $ 10.24 and so on

Believe it or not by day 20 or 20th deposit you will have?

How about you just see for yourself while you’re counting up all your money you deservedly saved up.

While you are saving up for your next “double it deposit” a trick is to play the regular jar game for the amount you need in order to double your last deposit. So you have two games going at once “double it” and the jar game the article explains.

Enjoy the game * best of luck * & you deserve every penny.

wow….I wouldn’t get bored with this “money game” if it was something I really wanted to do…We have money taken out of our account every month, and it always get put back into our account due to shortage in our account because of one thing or another. With me getting paid once a month and hubby getting paid maybe not at all in a month, it’s very difficult, but this would be something that we could do, safely I believe….So you “Rachell’s” out there that say only people who are spending frivolously and don’t save…you’re very wrong…there are people who do really try to save and don’t spend at all unless it is absolutely necessary

for all those gripin’ about how you don’t have the money to do this every week… change something that you’re doing… quit smoking… go out to eat 1 time less often… for cryin’ out loud when you first start out your putting $1 in the first week… next week you increase the amount you put in by $1 and so on until the last week you put in $52… I don’t know about you but If I take the wife out to eat and a medium priced restaurant we’ve blown $50 plus easy… so what if we don’t go out that week… we’ll have a steak off the grill at home and it won’t cost us near so much and it’ll be grilled to perfection…

Honestly…

I started this Jan 1, 2014, I started mine in a thick glass, skinny neck Cabo Wabo Tequila bottle that my son (bless his heart) had given me flowers in last Christmas. I think of him every time I put money in it. I can’t “steal” out of it, and I have no idea how I will get the $ out of it without breaking it, but it has been a fun challenge. Thanks to whoever came up with this brilliant idea!

CABO WABO!!!

Take me downnnnn ,take me downnnnn, to cabo wabo. Vanhagar song. Sammy Hagar brand

Why is there a $100 bill in the jar?

All America should think about saving. Don’t borrow money, rather save. You all got us in to the economic chrysis so even this kind of plan is better then the one where you max out all your credit cards and buy things that you don’t need. I am not saying that all of you are the same, but this is how are you presented in the world and this is my experience with America.

I started this project in early 2014. Now its already November and my mission is reaching accomplishment! Couldn’t wait to buy my iphone 6 soon. Lol. Very creative idea to save up. I’m not good at saving so this helped me in a way

My “crack change” goes into a Texas mickey bottle at the end of each day. It has a narrow neck so its difficult to get back out, so I can’t really steal from myself. Last year I had only done it for maybe 6months and I had almost $400! It took me a while to shake all the change out and roll it all…but I was worth it!And the majority was nickels and dimes…if I can start throwing my quartets and loonies and toonies in there too imagine how much I can save in a year!

Why can’t people get along without trying to smart off or have an attitude to someone about childish nonsense. For goodness sake. Save what you can and don’t criticize others ideas..

get a friggin bank account and I don’t wanna hear “they wont give me one”. Most banks offer 90 day temporary accounts to help people get re-established.

I know a better way. NEVER BREAK A DOLLAR. That is, One Dollar Bills. Get a jar, put all your dollar bills into it. Always break a 5 or 10, whatever, and use change, for a change. But, NEVER BREAK A DOLLAR BILL. I saved up over $800 in one dollar bills in just a few months this way!

Then you could place the dollar bills on wheresgeorge.com to track where your money goes as you spend those dollars. Would you be interested in making money with Jerky Direct?

Better than the jar, save the allotted amount of money per week and send it to a financial advisor who can invest it safely every week or every month for you! So much better than a jar, a sock drawer or even a savings account at the bank. We’ve made almost 40% on our savings this year in safe investments! Then you’ll see the savings REALLY go up!

Well the irs may not pay you interest for your “free loan”, but I’m pretty sure this jar doesn’t either and is a lot harder to remember to pay! Does anyone hear realize how small the interest earned would be on $1300 in a savings account anyway? Smh

Wow, there are a lot of miserable people on this thread … Wow

I think it should go something like 1 dollar, then 52 dollars, then 2 dollars, and 51 dollars and so on and so forth, especially if one lives on a tight budget, because 200 to 250 dollars in the month of December during Christmas would be horrible.

This is exactly what I do. It comes out to $53 every 2 weeks. I also never spend any change whatsoever. All change goes into a change counter and is rolled and saved until the end of the year.

here is my savings plan I set up 2 direct deposited from my paycheck that go into two separate bank accounts I have it setup for 150 a week that’s 7800 a year saved much better system and that’s ontop of my 401k and stock purchase plan

That’s a real savings plan!

No kidding…by the end of this it would take only a few days for me to wipe out my entire pay check…

I would have to have an extra $700 on my check to use JUST for this…If I could afford that I could afford the damn trip in the first place.

Most people who are not used to saving,or don’t have anything left over after paying their bills,probably won’t make it past the sixth week,and december will find only $21.00 in the jar. A better way to save,with out realizing your “saving” is to NOT spend any change you receive when you make a purchase,and put that in the jar,as example,if you buy something for $3.18,when you get home drop the .82 cents in the jar.The average person will have close to,or more than $1000.00 at the end of the year.And don’t take the money to a “Coinstar” machine to count and sort it,why give them 9%?Have some fun with your kids or grand children rolling it up your self.

Replace the jar with a tax free high interest savings account, the paper with a reminder app on your phone and/or set up weekly automatic transfers from your chequing account to your savings account. Just be diligent that the money will be in your account to transfer!

I think this is a lovely idea for those who can afford to have this in the budget. If you don’t think you can afford the extra money at the end of the year, switch it around and start off with $52 the first week.

If you truly cannot afford to put away $52, then this just isn’t for you. Of course, you could always just do a chart with weeks, amountt, and total and put in what you can.

Beligerent and Caustic.. thats all (mostly) I got from the MANY replies, or comments on this subject..Its a USEFUL exercise, but most people would rather pick it apart and trash the concept. ITS a guide to saving..it teaches discipline and commitment, but who am I to talk…anyway, if I was to give you a penny today , two tomorrow, 4 the next day, 8 on the 4th day, and so on, DOUBLING the value with each passing day till day 30, HOW much money (in dollars) would I have.. THIRTY days..

I’m with Ron. What the hell is wrong with everyone?!

Why is negativity on here…. this was just a way to save a little money without really noticing it was gone. The world is so bad now a days everyone disrespects everyone , we call each other names and talk down on one another, if there was a crisis we would die because no one could work together because we are so shoved up in our own butt that no one cares for abother! That to me is sad, if everyone cared this planet we call home would be alot better !

i don’t need a jar, i have an accountant that looks at these things for me. But maybe I will mention it to him lol. Oh and J, i make more than you, like 500k 🙂

Wow all the people sh*tting on this idea. No one is forcing you to make this. Some people want to do it for the fun of it. Why do you all have to be such frigging killjoys? JFC.

I never give out change each morning I don’t but when I get enough to roll in Ireland in a year and a half I saved up $2478.00. Over the years I’ve paid for two white water rafting trips for me at my so, two computers, 1lapto, two trips to Myrtle Beach and one trip to Florida and didn’t have to touch any of my household budget.

Hey this works i do this alot

This sounds like a good idea. In theory. I am on disability and get $1100 a month before deductions. I put $700 in mt pocket after that. After bills, I usually have about $50-$60 bucks a month left. This might work for most people but NOT for those of us on a fixed income

Why not just save $26.50 each week for the same amount at the end of the year?

Shameful! I make that in one day! Anyone can if they get off there lazy butts and apply themselves. Really? 1$ a week then 2$? Try putting away enough to retire when you are 50. That takes planning. Oh well, sucks to be yo guys I guess..

And you sir, are obviously roooolling in $$$. Some of us out here in the real world can’t live like that. You know that 13 year old who serves you at Maccas? Actually, you probably don’t… Anyway, that young person may be earning the only income for the family, because their parents are unable to work – say the mother is being held at home with six-week old child with Downsyndrome, and the father is physically disabled – that young person legally can’t get a job anywhere else. How is that family supposed to save $100 like you might? Take a heart and help those who are willing to work but can’t. Or stop being prejudiced.

Whether u agree with the idea or not.. Respect others and let live.. Might souns stupid for some cocky ones, or pretty challenging for others.. This is why i hate US, no one cares about anyone.. bunch of selfish!

is it that hard for u to respect other opinions but urs?

Like others, I found the increase makes November and December kind of difficult.

So I took a spreadsheet, and randomized the amounts for the days – so the load is spread out through the 52 weeks. It’s not completely even, but no month becomes overwhelming.

I saved all my loose change in a glass jar – quarters, dimes, nickels, and pennies. When they were filled, I took them to the bank to have it all counted. $300 just in change! I should have put it in the bank in a 5-year high-interest rate CD, but I needed it for daily living expenses.

I need to start emptying my change every day again. I also need to start putting some $1 bills away every day, too. I really wish I could put the $$$ away like they suggest in the chart. Maybe when I get back on my feet, I will be able to do that. I just need to start saving, and soon.

I remember working with a gal who was in her late 50’s-early 60’s. She told a group of my co-workers and me not to be foolish like she was and start saving as soon as possible. She said if we didn’t do that, we’ll be in sorry shape when 65 rolls around. Unfortunately, she is correct. I am 54 years old and have ZERO saved thanks to extended unemployment and foreclosure.

If only I would have been able to keep up the 401k, I can’t even begin to imagine how much $$$ would be in that account that was started in 1984.

I guess it’s never too late to start, though, right?.

It seems to me that this challenge was designed for people that have, but mismanage their money. I think its a great idea that needs variations that apply to all incomes. Is this just ‘budgeting for dummies’?

I’ve done this twice in the last year, I also did it in reverse. Start with the week 52 payment ($52.00) and work back, then the payment get less and less! I also doubled up my weekly payments by adding the week 52 & 51 payments, then 50 & 49 and so on.

All these people bashing people who have extra.taken off the paycheck and giving IRS or Revenue Canada an interest free loan to me are weird. I have an extra $40 per pay check in exchange for giving $4 -$5 in yearly interest I get a check that has an extra couple grand on it to do as I see fit. To me it is an effective extreme low cost forced saving plan.

Also before someone riparian me about other ways as to save I say a person has to save the way that works form them and are comfortable with, the main point is to save not if you are squeezing out that extra 0.07%.

For the record I believe in the multi prong approach so as the above I am lucky enough to work for.a.company that has a small pension plan and I also put $200 per month into a private pension plan (RRSP).

I still live paycheck to paycheck but I get to do one big hooray with my yearly check such as taking the kids to Disneyland a few years back and I took my daughter to Mexico to swim with the dolphins for her 13th birthday, etc.

Also.have to point out that living in Canada where it is the law of the land to have Universal Healthcare and the Canadian Pension Plan kinda helps with the saving of money now and for the future.

The only stupid idea here was your dad not pulling out. GTF out of here with your negativity.

Instead of me having to think about it, have money laying around and doing something like this, I opted to have my bank automatically move $50 into my savings account every time my paycheck is direct-deposited. That’s $1300 a year (26 paychecks) without me lifting a finger, PLUS as it happens the minute the check is deposited I never notice it’s missing (as that money was never really in my checking account for very long). I know my bank does this for free, and other banks probably do as well. It’s an easy way to build up a side fund for a rainy day, for emergencies, or for spending money, without having to do anything.

Whatever works 🙂

If it were as simple or easy as self control, it would have been done already. Read the post above yours for a real example of how this works. It’s about making less money – withholding money that would otherwise be directed to real bills, debts, repairs or other similar things – not frivolous ones. And then they use their windfall to make repairs on something that was broken. Those saying this is about frivolous spending that can be fixed with a little more self control, have another issue going on that isn’t about actual money.

I think it’s a fun idea! As I am not a very good saver, I am going to do this with a twist. At the week one mark, I am putting $104 in first and then working backwards by increments of two’s. Yes, I know it says to start with $1, but I think by December, my amount will be a tad more gratifying. I find my money starts to dwindle towards December, so by then my payments into this will be less.

Is it the meaning to save every new week 1 dollar more than the last week (like in the picture) or just only the amount of money that you have left over/can miss? If you can only miss one dollar a week than you don’t save 351 dollars at the end of 6 months, as the picture says

I agree. I think it’s a great idea.

This is a great idea, but any ideas on how to modify this for folks that are on social security?

i’m actually doing this in reverse. Starting with $52 in January and working backwards. Its always easier to save in the beginning of the year that way when you start getting near the holiday season (where most people are trying to spend spend spend …)you are down in the single digits for your savings plan!

Also for the “rich” and ignorant…its not about the amount of money….its about DISCIPLINE. If you cant discipline yourself to save an additional dollar per week (if you can afford it) you will never obtain wealth…..if you were honestly RICH you would know this because that is a BASIC principle….its about learning to discipline yourself and delay your gratification. MOST people if they really looked at it…can save SOMETHING…even if you only saved $1 per week it adds up over time.

Better try this: first day: one dollar, second day: two dollars, third day: four dollars, forth day: eight dollars; fifth day: sixteen dollars and so on: double the amount every day, and you will be REALLY rich when a year has past…

I think this a great idea. I have a constant outflow of money commitments so that however much I earn it gets spent. This is a simple, drip by drip saving system. Thanks.

I’ve never seen so many hateful posts as in this thread. WTF is wrong with you people???

Ok I understand how it works but I couldn’t do it to many weeks ive had to choose to dip into savings for food. But maybe adapt it if I saved 2 pound a week by the end I would have 104 so hopefully enough for a second hand sofa.

Cut it in half when able too and possibly add extra when able too. I am doing this for Christmas. I am a single mom and Christmas is tough. Weeks 1-10 I am doing $10 a week. This summer when my second job picks up (waitress at a lake side restaurant), I will add more also. Then in September wgen business slows and I can no longer add as much, I will have over compensated in earlier weeks.

I can vouch for this. I started this when I was 18 years old when I got my first job. Instead of starting back at $1 each year I continued to increase the weekly amount. Now 20 years later I have a big old barrel with over half a million dollars in it!

LOL.

Really? Your serious?

I opted to do the flat $26.50 per week automatic transfer from my checking to my savings each week. I’ve been doing this for three years now and A) don’t miss it and B) have had the money that I needed for car repairs that I’m not sure i would have had otherwise! So awesome!

I did this last year and it worked well, so this year I’m going to double it so instead of $1 I’ll put in $2 ect at the end instead of $52 i’ll try put away $104 I only earn 300 a week so by the end of the year it will be a real challenge. Can’t wait to see if I can do it.

Sounds like fun. I may try it.

Yes this is a good idea. BUT, you will probably not be able to afford a ski trip with 1,300 dollars. Aircraft tickets are expensive and then yoy have to include rental cars, hotels, lift tickets, food, etc. $1,300 is simply not enough. HOWEVER, if you doubled or tripled the amount of money deposited (say start by depositing 2 or 3 dollars), you could afford it. But this is a good idea.

CORRECTION: You, not yoy.

Easy way to start saving ..

At Christmas time… spent about hundredfifty dollars.. No way

I think I’d put aside an even amount ($30/week) automatically into a separate savings account, with auto-deposits of payroll (total ~$1560/year). Adjust according to goals. It’s just easier to learn to live w/o it on the outset, and keep it going as plans demand. New mortgages are a shock to the budget, but you get acclimated to not having that cash, and it pays off (building equity).

The difficulty is learning to wait on that ‘vacation’ or big purchase, by getting yourself ready to pay it all in cash. These days it’s all about buy now, pay later, often getting rewards for using credit. Paying cash for big items is a discipline, these days, and one that’s always worthwhile learning (and teaching kids).

I think that Kristen said it all and I think this is a fantastic idea both hubby and I are going to have a go at it!

Lord have mercy people! First off, if you can’t afford your children, YOU SHOULDNT HAVE HAD THEM! And if you can’t afford to save 1 to 5 dollars a week, something is SERIOUSLY WRONG WITH YOU. Do without that latte, shop at thrift stores, eat beans instead of meat, and don’t vote against your demographic! This thread really makes me want to save, but the dumbasses that post against it make me want to jump off a cliff for being part of a society that can be so stupid that they vote into office people who have not a care about them, only the rich elite and corporations (yes I’m talking current news here)! This is an awesome plan for saving a little money. If you did it every year you would actually have a little cash to invest! EWP

Better to do it the opposite way! You put the most in early in an interest account so you get more interest. Have more $ after Christmas from returns & then you get a tax refund you can use & then at Christmastime you are only putting in small amounts!!!

get paid monthly so have to adjust and put a lot in some months near the end….

My husband and i love doing this challenged! ? and we round it off to 3k every Dec. and its our 3rd time doing this! big help for xmas

I have to try harder to challenge myself. I hope it can be like you